Call Us: 949-673-8299 Email: davetax@davetax.com

Tax Checklist

Specializing in Personal Income Tax Filings

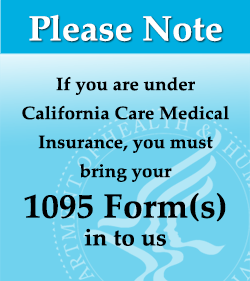

Important!

- HEALTH CARE FORM 1095

- DRIVERS LICENSES (only for new clients and renewals)

Income:

- W-2's & 1099 Forms

- Interest income from savings/checking

- Stock & Mutual Fund dividends

- State tax refund from previous year

- Unemployment

- Retirement plan or IRA distribution

- Alimony received

- Sale of stocks: ORIGINAL COST BASIS & sale prices: brokerage statements & 1099's, Please bring your REALIZED GAIN/LOSS REPORT

- Sale of Real Estate

- Bitcoin & Cryptocurrency Sales, all totaled up

- If self-employed: Totals of business income & expenses

- Partnership, S-Corp and Trust: K-1 FORMS

- Rental income and expenses for each property

- Pension income, IRA and Roth IRA conversions

- Social Security payments

- Other Income: Prizes, Lotto, Gambling winnings, Cancelation of Debt 1099's & legal Settlements

Adjustments to Income:

- IRA contributions

- Student Loan interest

- Educator - Teacher expenses

- Health insurance paid (if self-employed)

- College Tuition deduction

- Electric plug-in vehicle deduction (Final in 2025)

- Self-employed SEP-IRA Contributions

- Health Saving Account info: 1099 - SA FORMS

Itemized Deductions:

- Medical bills paid. (If more than 7.5% of your income)

- Property taxes

- State Taxes for previous years (If paid last year)

- Auto DMV fees

- Mortgage interest

- Points paid on refinancing or purchase of home

- Charitable donations. (Money & used goods)

Other Important Items:

- College students must bring in their 1098-T form from their school for Tax credits

- Child care: Name, address, Tax ID # and phone #

- If you bought or sold property during the year: bring in the ESCROW SETTLEMENT STATEMENTS for the purchase & sale

- Copy of last year's Tax returns ** New Customers only**

- State withholding Form 593 for sale of real estate

- Estimated Taxes Paid

- Solar Energy purchase information (Final in 2025)

Member of